Vyapar Mitra Business Loans

Operating capital is vital for any business, whether it’s a nano, micro, small, or medium enterprise. Vyapar Mitra business loans are a tailor-made finance solution for small business enterprises.

Whatever the requirement, be it replenishing the stock of your Kirana store or expanding your Hardware Shop, our Vyapar Mitra Business Loans have

got you covered. Whether you are a retailer, medical shop owner, wholesaler, or footwear shop owner who earns a daily cash flow, you can count on

Vyapar Mitra as your finance partner. You can trust us in your entrepreneurial journey to provide Optimal Loan solutions.

Reasons To Apply For Vyapar Mitra Business Loans

With our collateral-free business loan, you can solve a variety of purposes, including:

- Increasing your business Liquidity!

- Enhance your working capital float!

- Expanding the size of your business premises!

- Building credit for the future!

- Spending money on marketing of your business!

- Purchasing inventory!

- Add a new line of products or services to your business!

- Build your Credit Score!

Key Features and Benefits of Vyapar Mitra Business Loans From Muthoot Fincorp

Muthoot Fincorp offers customized business loans for millions of Nano and Micro businesses in India. Our loan offering is designed primarily to serve small businesses with a daily cash flow who lack the formal income documentation to qualify for loans at banks or other financial institutions.

We have designed our processes with a blend of human interface augmented with technology. Our 136-year legacy comes with the utmost transparency, trust, and care when dealing with the financial needs of an entrepreneur.

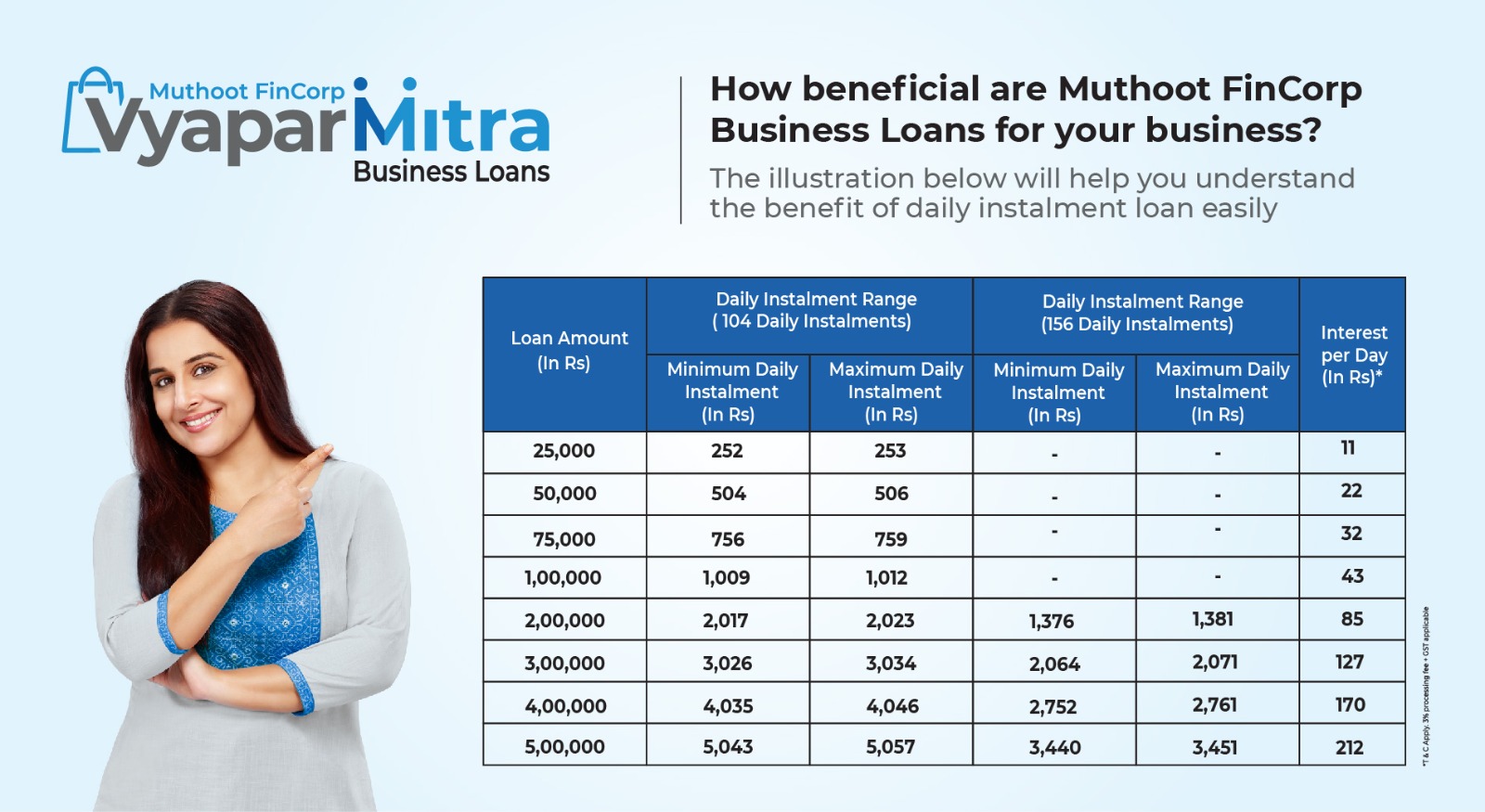

Get Business Loans up to ₹5 Lakh

We offer business loans of ₹25,000 up to ₹5 Lakh to eligible MSMEs. Our loan window designed to support … read more working capital needs up to 6 months where you can repay it on a daily basis.

Faster Processing Time

Against a normal TAT of 10 to 12 days taken by Banks or other financial institutions, our processing of entire … read more loan proceedings happens in 2 to 3 working days. Because we understand the value of your time.

Improve your credit score

We finance customers who has a low credit score due to unforeseen events like COVID or an… read more unfortunate events in the family. We also supports customers who does not have credit score. Vypar Mitra is an ideal partner to build your credit score thru a proper daily repayment.

Optimize your Daily cash in and out flow

You don’t need to worry about paying a working capital loan for a long-term period. The principal … read more and interest daily kept diminishing based on repayment hence you don’t ending up paying higher interest amount. Our skilled team members will guide to take the right loan amount to suit your daily cash flow.

No collateral required

Our business loans are collateral free, so, no worries about blocking your valuable … read more assets like Home or business shop for taking a loan.

Competitive interest rates

Our rates are based on daily diminishment in nature. Our purpose is to help you coming out of the clutches… read more from local money lenders who charges an exorbitant rate. Same time our rates are competitive or even cheaper comparing peer level financiers.

Convenient Repayment Tenures

Our repayment options are 104 or 154 Equated Daily Instalments (EDIs) based on loan amount and the business … read more sectors. These tenures are tailor made to match the typical working capital cycle of any trader or retailers. You can make digital repayments on a daily basis from your UPI App or through Muthoot Blue App. If you face any technical issues our experienced staff will meet at your place and assist for daily collection.

No Hidden Charges

There are no hidden charges in our loan terms. Any time you can prepay the loan, save future interest and … read more based your repayment history you are welcome to come back in need for another term of loan. We do only charge a processing fee of 3% excluding GST per loan to cover our service costs.

Simplest Documentation and Loan Estimation Process

Vyapar Mitra requires only minimal documents. Up to a loan of 3 Lacs, we don’t require your formal income … read more documents apart from KYC, business, resident ownership proof and Bank proof. Our staff meets you at your business premises to understand your requirement. and based on a mutual discussion we prepare a loan eligibility calculation.

Life and Loan Protection through Insurance Cover

Our loan products come with a bundled life cover and loan protection from leading insurance companies… read more at a very economical premium.

Eligibility Criteria Required for Vyapar Mitra Business Loans

- The age of the applicant should be between 21 years to 65 years

- The business should generate daily cash.

- It is mandatory to have a co-applicant (21 to 65 years range) from blood relation, e.g. spouse or parents

- Your business needs to have a vintage of minimum 2 years.

- You should have an operational bank account.

- You need to own a residence or a business premises.

Easy Documentation for Muthoot Fincorp Vyapar Mitra Business Loans

Vyapar Mitra small business loans from Muthoot Fincorp needs minimal documentations as follows.

Photograph

- A recent passport-sized photograph of applicant & co-applicant

Proof of Identity & Age Proof (Applicant & Co-applicant )

- Passport / Aadhar card / Pan card / Voter ID card

Valid Residence ownership cum Address Proof

- Tax receipt, water tax bill or electricity bill

Business Ownership Proof. (In the Customer’s name)

- Local business license/ SSI certificates/ Any govt or regulatory license to run the business.

Income Proof

- Less than 3 Lac, no income documents mandatory.

- 3 Lac and above, the latest 6 months or quarterly GSTR -3B or ITR for latest year need to be submitted based on requirement.

Banking Proof

- Last 3 months’ business bank statement

*These documents cover all types of loans for Vyapar Mitra Businesses-Proprietorship, Partnership and Private Limited companies.

How to Apply for Vyapar Mitra Business Loans from Muthoot Fincorp?

Now that you have made up your mind to apply for a Small Business Loan, the best way is to visit your nearest Muthoot Fincorp branch or call our customer care representative at 1800 102 1616.

Frequently Asked Questions

It depends on your business vintage, monthly sales, and working capital needs. Our staff will meet you, collect the necessary documents and business details, and give a clear calculation of loan eligibility for the daily instalment. Our advice to our customers is to be transparent and factual about your business figures so that loan amount calculations will be accurate.

Vyapar Mitra loan is designed for investing and growing your business , not for any personal usage.

If you can provide all required documents and information completely, it will fast track loan processing.

No. you can prepay your loan at any time without charges.

Vyapar Mitra is primarily a working capital and general business improvement Loan . It’s not designed for long term capital investment. So paying daily instalment reduces principal and interest on a daily basis. It will help to balance your daily cash flow no need to carry a repayment burden for long time.

Always go a Business loans after assessing the purpose, profit margin, and working capital cycle of your business. Being a responsible financier, our guidance to customers about choosing optimal loan amount. If you choose the loan amount based your daily payment comfort, short tenure non-collateral business loans can be one of the best working capital finance options.

Not mandatory. Our teams can meet at your convenience. But visiting our Branches is always welcome to experience Muthoot Fincorp’s customer service. After all, we have 136 years of care to share with you !!.

The branch locator on the website can also guide you to a branch near you. Or you can call us at 1800 102 1616 to know more.

Muthoot FinCorp Branches

Step into your nearest Muthoot FinCorp branch to know more about Vyapar Mitra business loans!

By using our branch locator tool, you may quickly find a Muthoot FinCorp branch close to your desired location.

Vyapar Mitra Business Loan Calculator

Our Vyapar Mitra business loan calculator is a tool that can help you plan and organise your loan requirement better. You can easily calculate the EDIs and take an informed decision.

Know your EDI outflow

Note. For EDI say there are 106 instalments but Loan duration is 104 days.

Why Choose Muthoot Blue For Vyapar Mitra Business Loan?

Muthoot Blue (Muthoot Pappachan Group) has a reputation that has been shaped over decades with high-quality practices, total customer satisfaction, and steady growth. Today, Muthoot Fincorp, our flagship company, is one of the largest NBFCs in India and we continue to work with the aim of providing timely credit to common man with Blue Soch. Hence, our auto loans are designed to make it easy to own one’s dream ride!

- We have over 3600+ branches across India. Visit your nearest Muthoot Blue branch to get a loan quickly and without any hassle.

- Nearly 1 Lac+ customers walk into our branches daily and are assured of our trustworthy services.

- Our customer-centric approach and innovation over the past 136+ years without compromising on the God-given values of trust, truth, transparency, and tradition is what helps us in empower human ambitions.

Need Help?

Please feel free to contact us. We will get back to you. Or just call us now.