14-Jul-2020

Muthoot FinCorp NCD bonds June 2020 – Invest 1 Lakh and get 1.6 Lakhs in 5 years – What about risks?

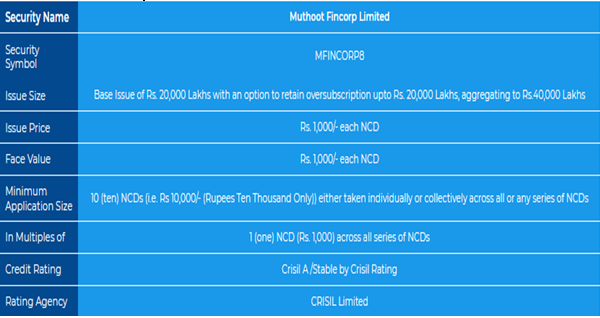

Muthoot FinCorp, the flagship company of Muthoot Pappachan Group (known as Muthoot Blue), on Friday launched its eighth public issue of secured and unsecured redeemable non-convertible debentures (NCDs) to raise ₹200 crores with an option to retain oversubscription up to ₹200 crores, aggregating to ₹400 crores.

The funds raised will primarily be used to augment the working capital and requisite lending, said Thomas John Muthoot, Chairman, Muthoot Pappachan Group, and Managing Director, Muthoot FinCorp.

The company has received board approval to raise NCDs through the public issue in the aggregate amount of up to ₹1,500 crores. The first tranche of the issue with a face value of ₹1,000 each and a minimum ticket size of ₹10,000 (10 NCDs), had opened on September 28, 2020, and closed on October 23, 2020.

“The second tranche of the issue with the face value of ₹1,000 and a minimum ticket size of ₹10,000 (10 NCDs) opens now and is scheduled to close on January 25, with an option of early closure or extension in compliance to SEBI debt regulations,” Thomas John Muthoot said.

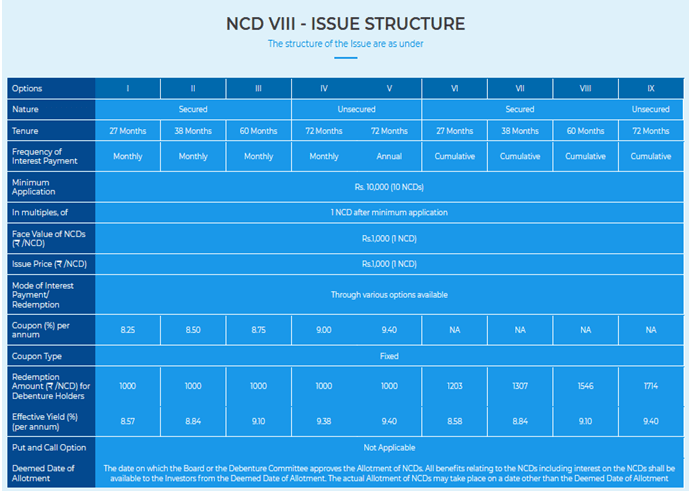

There will be nine options with tenure options of 27 months, 38 months, and 60 months for the secured NCDs, and a tenure option of 72 months for the unsecured NCDs, offering returns with interest rates ranging from 8.25 percent to 9.40 percent. The issue has received credit rating ‘CRISIL A/Stable’ from Crisil.

“Muthoot FinCorp has a diversified portfolio of products that are responsibly designed to empower our customers for their lifecycle needs. In the prevailing market conditions, especially when the Indian economy is restarting, we have been experiencing a spike in demand for MSME and gold loans,” Thomas John Muthoot pointed out.

“In order to enable nano, micro, and small businesses, our target customers, rebound, the company needs the infusion of more working capital and hence the decision to go for an NCD issue. The first tranche was received well by our investors, and we managed to raise ₹397.14 crores,” he said.

Muthoot FinCorp, along with sister companies, has lakhs of customers actively engaged with it on a day-to-day basis. “We are confident about the success of this NCD issue, and hope that this will further fuel growth in the economy and add more value to stakeholders, including our investors,” Thomas John Muthoot added. Muthoot FinCorp NCD is being offered in tenors ranging from 27 months to 72 months and is rated ‘A’ by CRISIL

Muthoot FinCorp Ltd launched a non-convertible debenture (NCD) issue, offering yields up to 9.40% for a six-year tenor, on Friday. You can opt for monthly, annual, or cumulative interest payment options.

The issue which opened on 1st Jan 2021 will remain open till 25th Jan 2021. The NCD is being offered in tenors ranging from 27 months to 72 months and is rated “A” by CRISIL. The issue size is ₹200 crore, with the company retaining the right to keep an additional ₹200 crore from the proceeds.

Download Muthoot FinCorp NCD Prospectus

The VIII-series NCD issue from Muthoot FinCorp has been rated “A (Stable)”by CRISIL Limited.

Interest on NCDs is taxed at your income tax slab rate. Hence, investors, particularly those in the highest tax bracket, should consider the post-tax yield on such NCDs.

This issue is available only in Demat form. You can apply online by logging into your demat account. Application forms can also be downloaded from the Muthoot FinCorp Website or the lead manager website. For more information refer to prospectus or Click Here

CRISIL upgrades Muthoot FinCorp’s rating to A+ Read More

Harshit Agrawal 2021-04-11

Muthoot FinCorp Launches NCDs To Raise ₹300.00 Cr Read More

Harshit Agrawal 2021-03-30

Muthoot FinCorp NCD Launches with Yields up to 9.62% Read More

Harshit Agrawal 2020-09-30

Muthoot FinCorp NCD bonds June 2020 – Invest 1 Lakh and get 1.6 Lakhs in 5 years – What about risks? Read More

Harshit Agrawal 2020-07-14